The NEW approach to your mortgage.

At NEO Home Loans, we empower you with financial literacy and help guide your journey to financial freedom.

Schedule your dreams & goals call

Audra McMahon

Branch Leader | NMLS# 268341

Audra McMahon is a powerful speaker and financial literacy expert. She brings 2 decades of expertise in the Mortgage industry and is uncompromisingly focused on helping her clients get a handle on their finances. Because of her personal struggles and passion for assisting others, she became a Certified Mortgage Planning Specialist (CMPS) and a Certified Divorce Lending Professional (CDLP). As a result, she also founded Option29.org, a for-profit business organization committed to helping people navigate the pain and ambiguity of separation and divorce.

With Audra and her team, you get a formidable force behind you to guide and support you through your transition in and after divorce. As you know, so many rippling effects linger for years following a divorce. If known during the divorce, you can wrap it up more quickly and cost-effectively.

Audra McMahon brings ambitious results, influential leadership, positive coaching, financial expertise for women and men. Every client gets her expertise in mortgage lending, and transition during divorce through community connection in real-life experiences. Audra is also a best-selling author of Preparing For Divorce Financial Health Assessment and Living An Intentional Life A Gratitude Journal. Both her books are published on Amazon.

No matter your needs, you can count on Audra to help you through the minutiae of divorce. Every situation is different. Her mission is to provide you the knowledge, expertise, confidence, and clarity over your case helping you separate emotion from logic and make wise family and financial decisions.

Working with Audra, you will gain the confidence to push forward. Whether you are looking to finance your property, negotiate your banking situation, or want a divorce without the financial impact, we have something for you.

We are here to help you be an active participant in your divorce process and find your success, peace, hope, and happiness.

You can count on Audra's warm smile, positive mental attitude, and straight shooting. She will help you learn to create a balanced, consistent, harmonious environment around you over time.

Audra lives in the greater Kansas city area with a network and community of divorce care professionals that actively practice their craft and are the cornerstone to the success of all her clients.

The NEO Experience

Being a successful homeowner is so much more than just buying a home and making your mortgage payment. The NEO Experience will make sure your home will always be a powerful tool that can help you achieve your financial goals, create generational wealth, and enjoy a secure retirement.

OUR PROCESS

Step 1

Discovery

We need to learn about you so we can understand your financial situation and long-term goals before we prescribe a mortgage strategy.

Step 2

Strategy

We will analyze mortgage options with the lowest cost and greatest prosperity potential for you and your family, then present you with a Total Cost Analysis - a digital and easy-to-read breakdown of your mortgage options.

Step 3

Execution

We create a flawless home loan experience for you. If you are in a highly competitive market, we will position you to close your loan as quickly as possible. If you need more time to prepare, we will continue to advise you on your financial situation until you are ready to buy or refinance your home.

Step 4

Wealth Maximization

Your life and the real estate market where you live can change rapidly. Even after you are in your new home, we will continue to manage your mortgage and help you maximize your wealth.

The closing of your loan is just the start of our relationship.

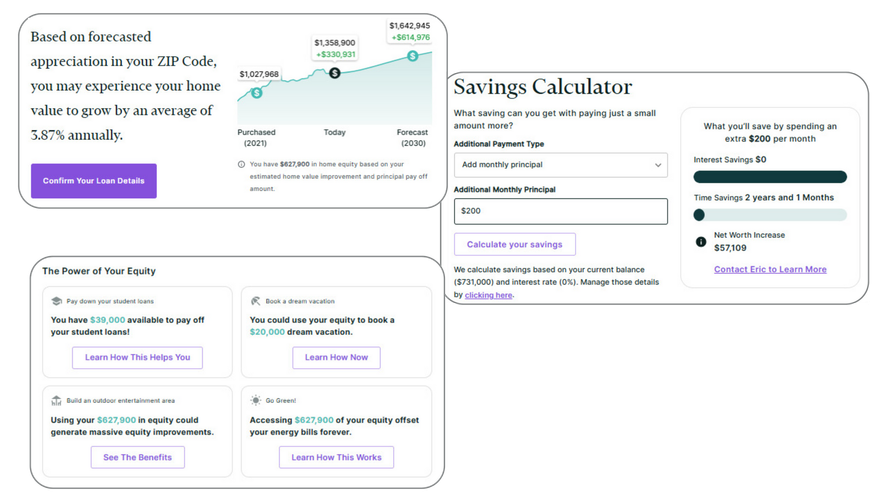

Stay informed about the value of your home!

Our monthly report offers an intuitive financial dashboard, tailored to enhance your wealth-building journey with your most significant asset: your home.

We are committed to ensuring you always have a clear and accurate understanding of your home's value and its impact on your family's financial wellbeing.